Excel Spreadsheet: VAT Partial Exemption Calculator

Excel Spreadsheet: VAT Partial Exemption Calculator

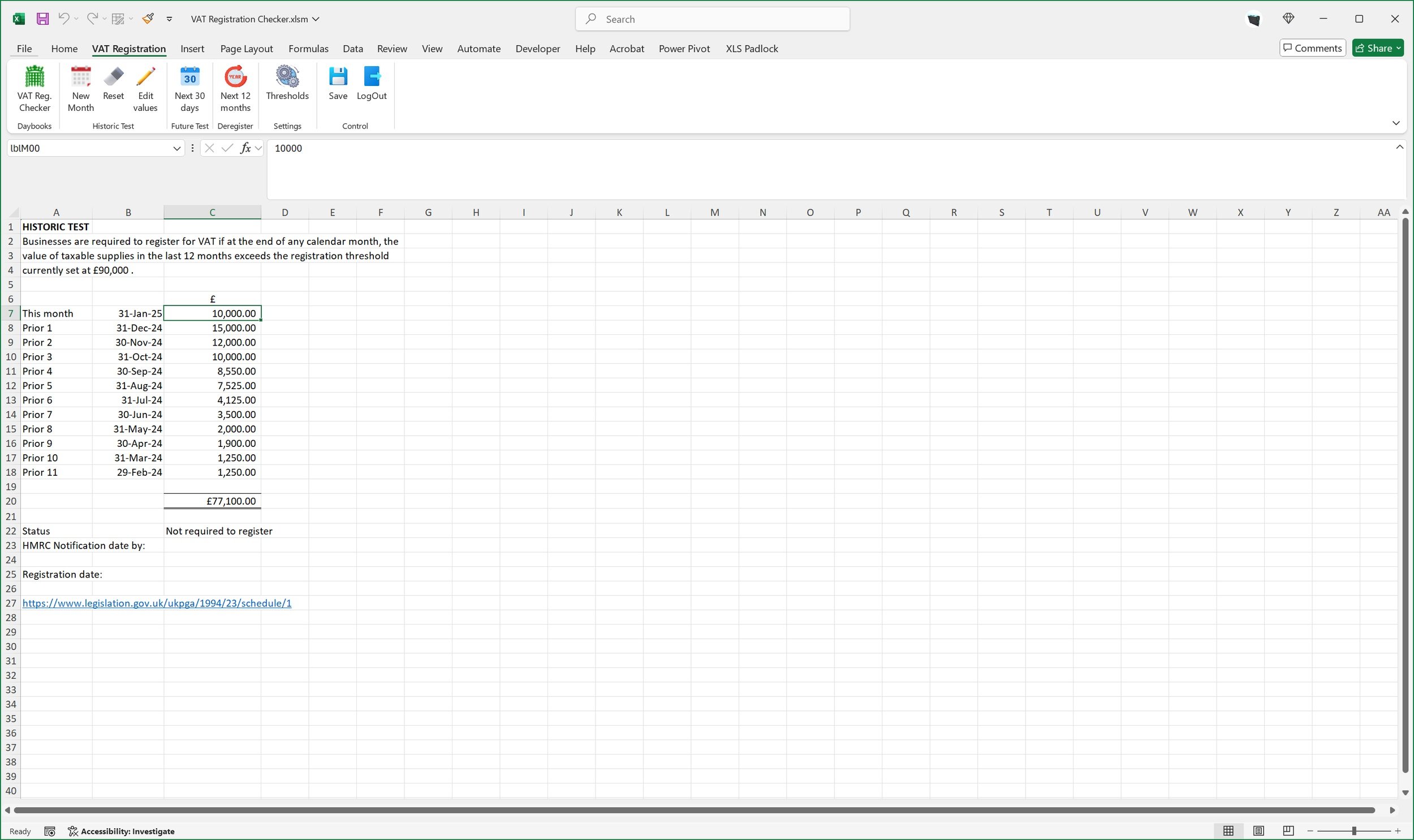

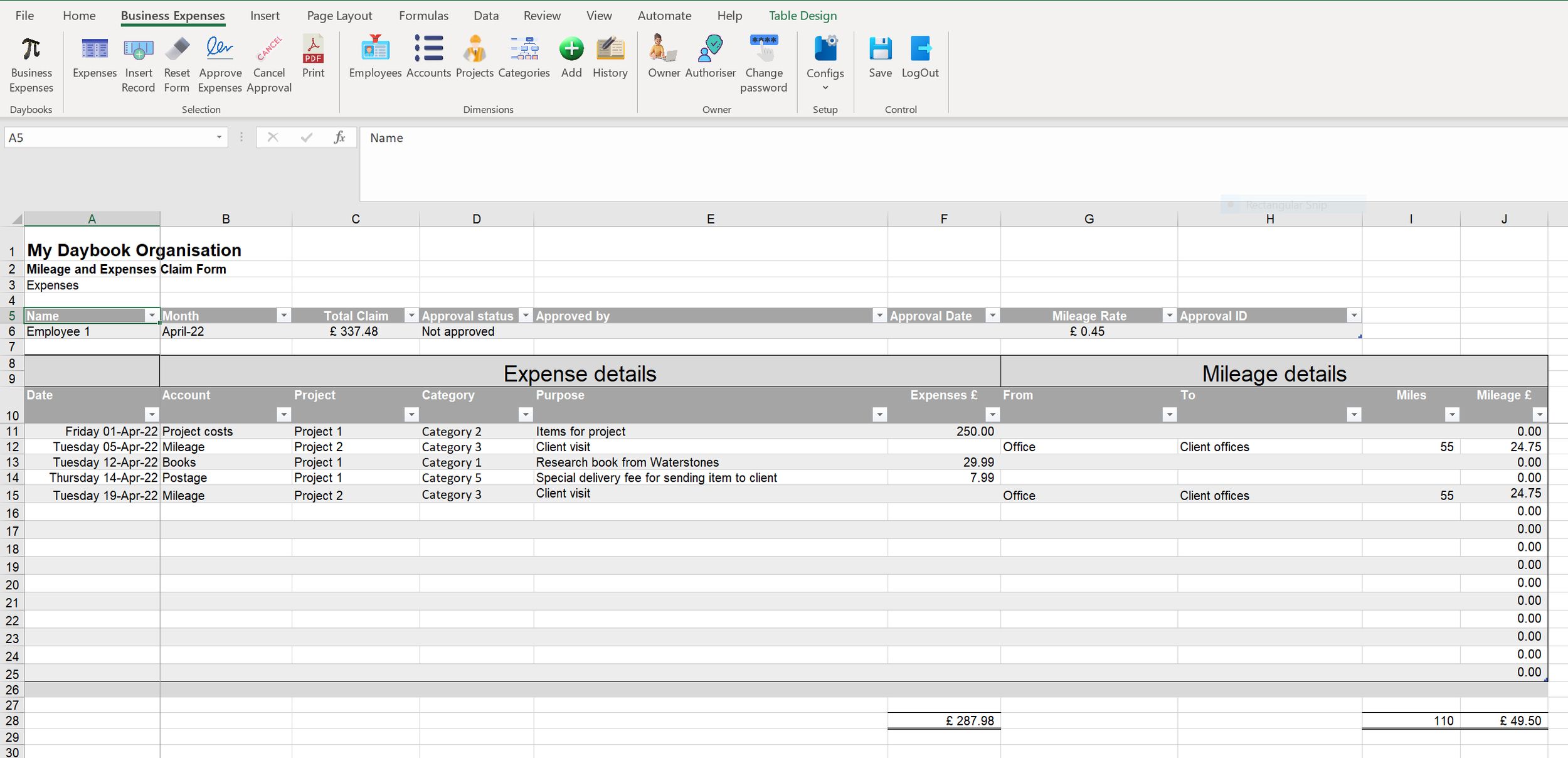

VAT partial exemption can be tricky to navigate. This spreadsheet is designed to take the hard work out of performing your quarterly partial exemption calculations and then making the annual adjustments.

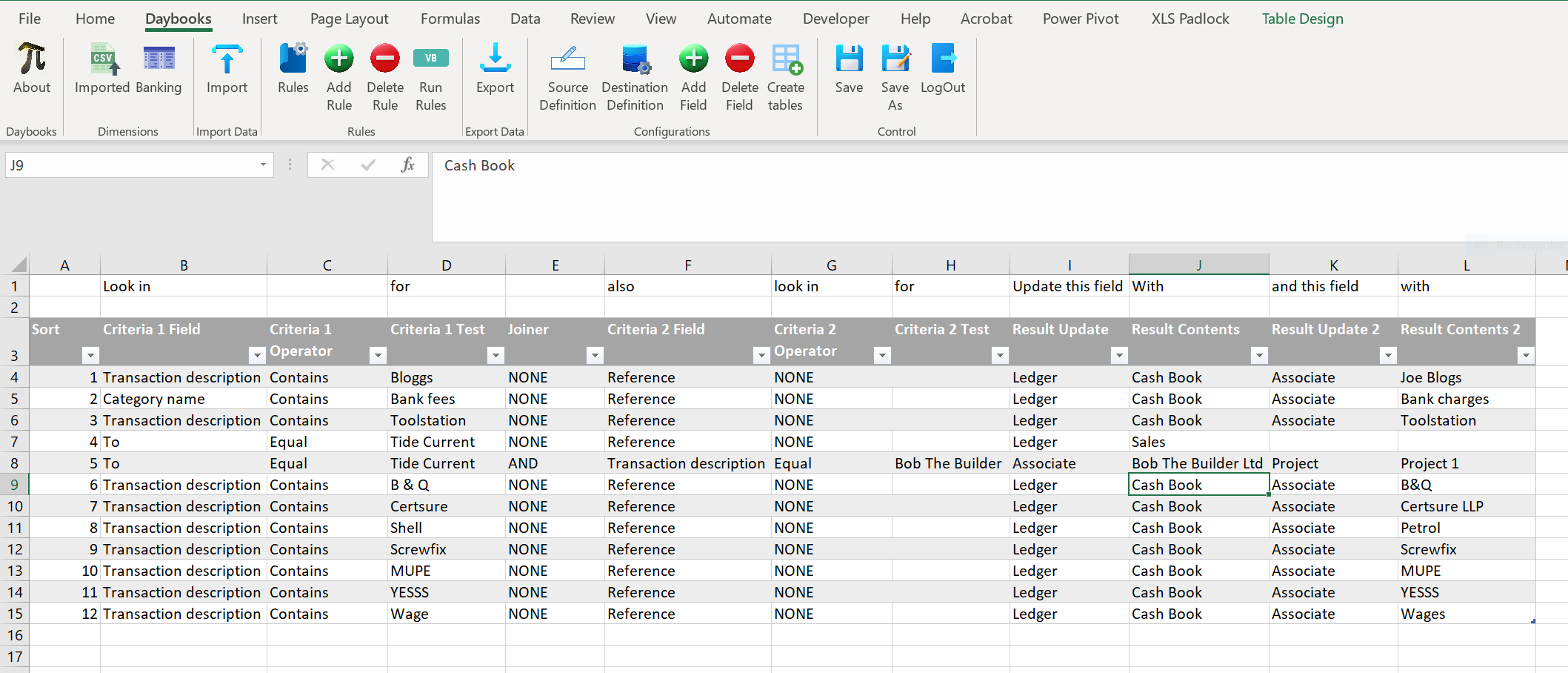

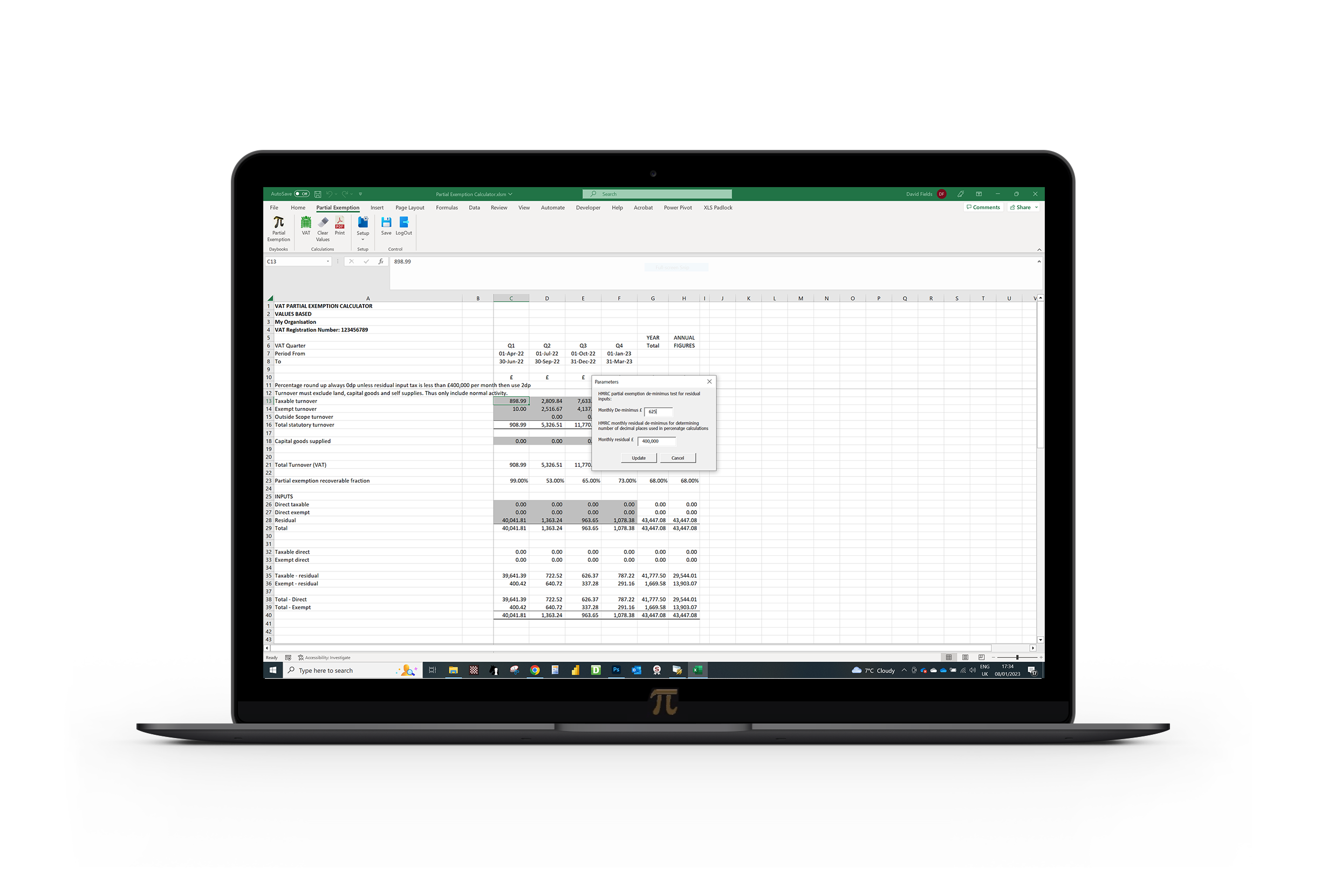

Enter your quarterly turnover figures along with your inputs broken down between direct taxable, direct exempt or residual and then let the spreadsheet perform the various de minimus tests to establish the amount of recoverable input tax. At the end of the year your four quarters are compared to the annual calculation to determine what adjustment, if any, is required.

Reference is made to the legislation for information and understanding on the spreadsheet but there is also an accompanying guidance explaining in more detail.

The spreadsheet will be securely downloaded and is macro enabled for functionality.

In the box:

VAT PARTIAL EXEMPTION SETUP V1.2.EXE - A code signed file to securely download the following files:

Partial Exemption Calculator(v1.2).xlsm

Partial Exemption Guidance.pdf

This updated version automatically sets your VAT Year end based on your accounting period and your VAT stagger periods. It allows you to override these if needed. It also includes an update to the Simplified De Minimus Test 1